Investment Strategy

capital growth through a diversified portfolio.

Primaz USA – Operates under a robust LLC structure,housing three specialized subsidiaries to drive operational efficiency and capitalize on diverse opportunities in the real estate market. This integrated yet segmented approach ensures flexibility, expertise, and growth potential across all areas of real estate investment.

Real Estate

The Real Estate strategy targets a diverse portfolio of commercial real estate developments to seek stabilized cash flows.

Real Estate Targeted Returns

- Stabilized Assets (15-20%)

- Development Projects (20-30%)

- Value add Projects(22-30%)

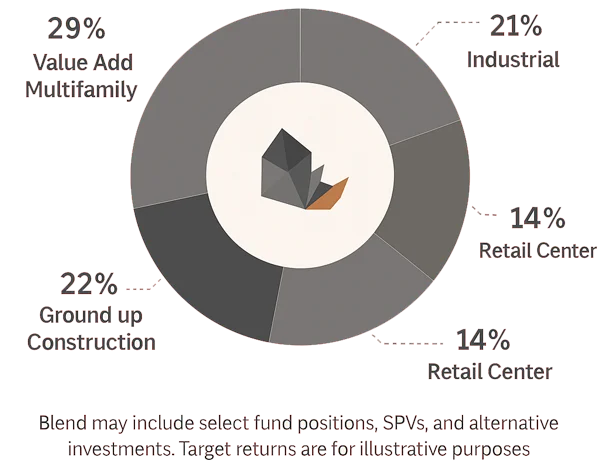

Funding the Fund

Investments in opportunistic real estate projects in multiple sectors, consisting of Value add and development strategies. Our portfolio strategy aims to democratize access to exclusive investment opportunities traditionally reserved for institutional-grade investors.

- Target is for blended VC and RE investments

- Applies to RE only

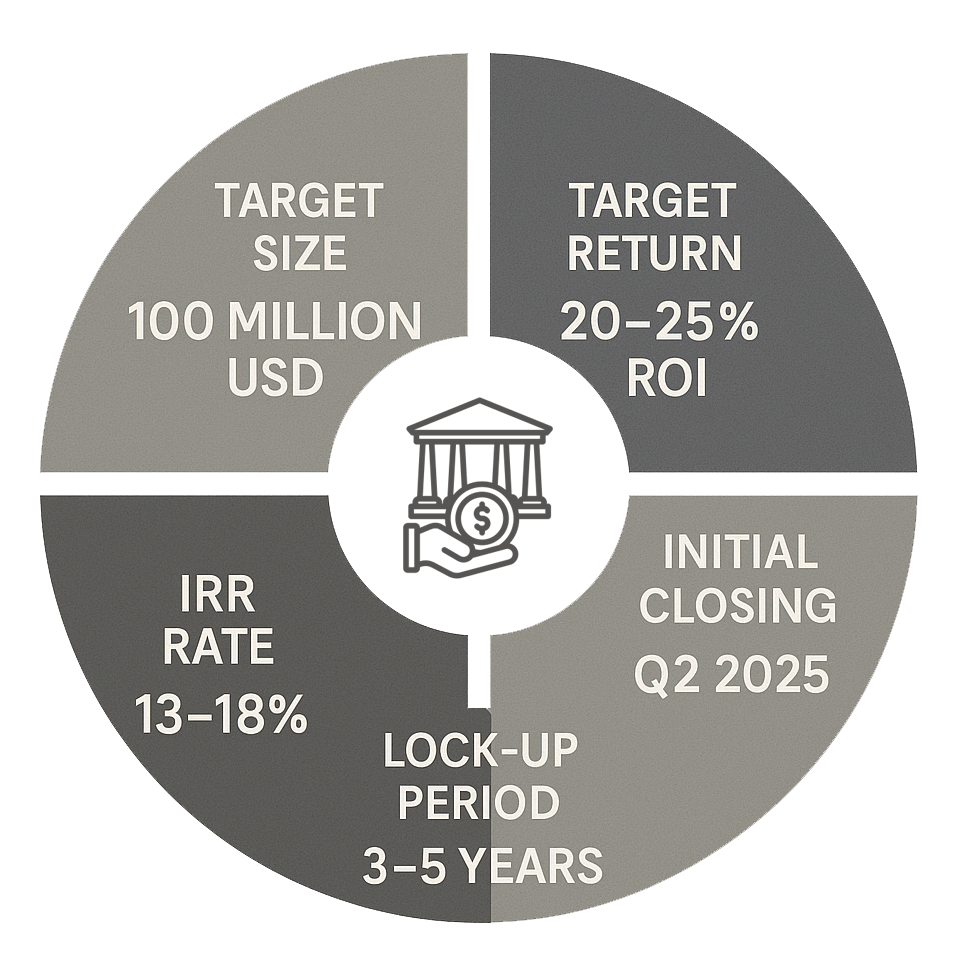

Target Size: 100 Million USD

Target Return: 20–25% ROI

Co-investment Rights: Yes; real estate and on a deal-by-deal basis

Initial Closing: Q2 2025

Fund Structure: Open-ended

Lock-up Period: 3–5 Years

Preferred Return: 12–15% (real estate investments)

IRR Rate: 13–18%

Management Fee: 2% per annum

risk management

Economic

Diversified Portfolio: Spread across asset classes and regions to reduce risk

Inflation Protection: Targeting assets that perform well during inflation

Regulatory

Full Compliance: Partnering with top law firms and tax advisors to ensure 100% regulatory adherence.

Tax Efficiency: Strategic planning to minimize tax burdens while staying compliant

Operational

Proactive Maintenance: Regular upkeep to preserve property value Efficient

Management: Optimizing performance through experienced management and technology

Market Volatility Risks

Diversified Portfolio: Spread across real estate sectors and regions to minimize risk.

Targeted Investment: Capital deployed only when opportunities arise, ensuring active funds.

Long-Term Focus: Patience and stability, avoiding reactions to short-term market changes.

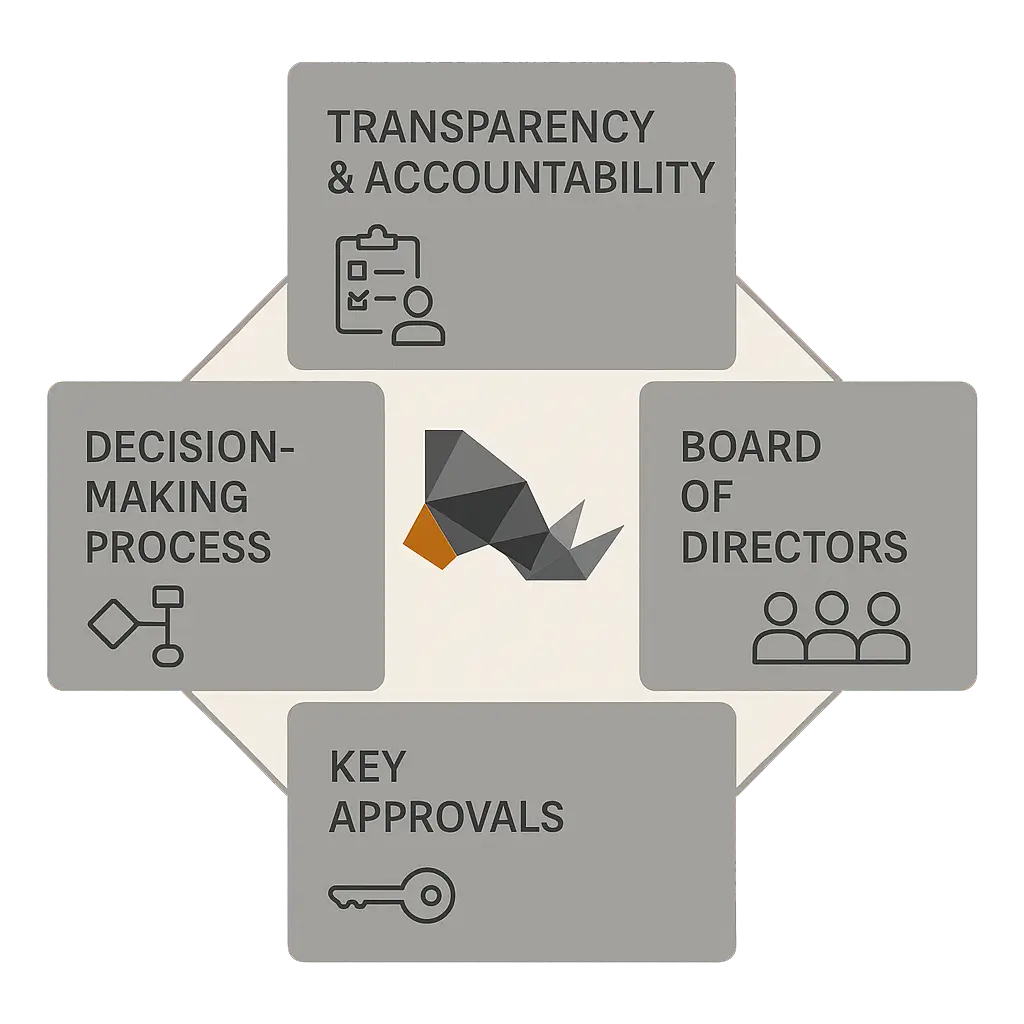

Governance Structure

Decision-making process

Clear Structure: Defined roles and responsibilities for all key stakeholders.

Regular Evaluations: Periodic reviews to stay aligned with market conditions.

Board of Directors

Leadership Team: Composed of our internal U.S. & Brazil teams and key investors

Collaborative Oversight: Ensures strategic alignment and effective decision-making

Transparency & Accountability

Quarterly Reporting: Regular financial updates provided to investors.

Timely Communication: Ongoing updates on performance and strategy

Key approvals

Board Approval: Required for acquisitions, profit distribution, and major decisions

Investor Focus: Decisions prioritize long-term value for stakeholders

Opportunity to invest in an innovative real estate portfolio

Primaz USA’s growth potential lies in its innovative solutions and strong market positioning, giving it a competitive

edge through quality, reliability, and customer-centric approach.