Strategic Real Estate Investments

High-quality assets delivering cash flow and growth.

Targeting High-Growth Markets

Investing in regions with strong demand and returns.

Balanced. Diversified. Resilient.

Smart diversification for steady, long-term success.

Primaz USA – Forward Thinking

Transforming Real Estate Investment

At Primaz USA, our mission is to deliver long-term capital appreciation and steady annual cash flow for our investors through a strategic, data-driven approach to real estate investment.

What sets us apart is our ability to seamlessly integrate asset management and property management into a scalable, tech-enabled platform with diverse revenue streams. We leverage deep industry expertise and strong market relationships to source high-value, off-market opportunities and drive superior returns through targeted value-add strategies.

Our Investment Vision

Long-term capital appreciation and annual cash-flow for investors

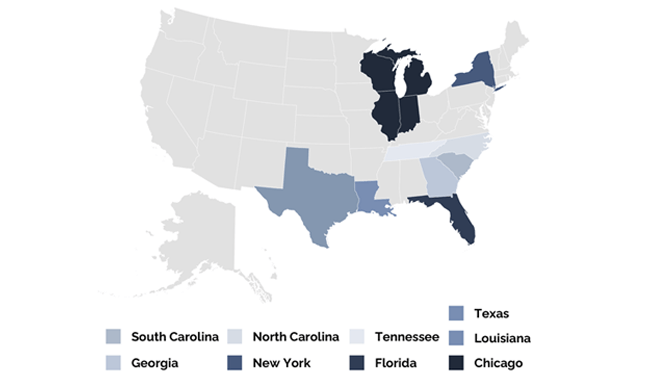

Target Markets

We focus on high-growth regions in the East Coast,Midwest, and Sun Belt, targeting multifamily,industrial, and mixed-use properties to capitalize on demand and diversify investments.

business strategy

Integrated yet segmented approach

Asset Management

Focuses on acquisition, financing, and strategic portfolio management, targeting off-market properties with significant value-add potential to generate above-market returns.

Property Management

Ensures operational excellence through proactive tenant relations, building maintenance, lease optimization, and detailed financial reporting to enhance asset value.

Brokerage Services

Supports internal initiatives and facilitates external transactions, offering leasing, sales, property valuation, and off-market opportunities to maximize investment outcomes.

target market

Focus regions:

East Coast, Midwest, Sun Belt

High-Growth Regions

Economic hubs like New York, Chicago, Texas, Florida, the Carolina’s and Atlanta drive real estate demand.

Expanding Industries

Tech, finance, and logistics sectors fuel job creation and property appreciation.

Strong Demographics

Population growth and migration trends support demand for multifamily, industrial, and mixeduse developments.

competitive advantage

We apply a disciplined, analytical approach across all stages: due diligence, execution, and exits, ensuring our projects align with investor return expectations.

Strategic Investment Selection

We prioritize projects that combine growth and cash flow, ensuring they meet our high standards for risk,return, and alignment with investor goals.

Experienced Team

Our team brings deep expertise from both the real estate and venture capital sectors, with a proven track record of identifying and working with top-tier teams.

Return-Driven Focus

We structure each project to meet clear return objectives, rejecting opportunities that don’t align with our established return policy.

Exclusive Access to Deal Flow

Our extensive network grants us access to proprietary and institutional deal flow, ensuring we secure high-quality investment opportunities.